"Price fluctuations have only one significant meaning for the true investor. They provide him with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal." - Benjamin Graham

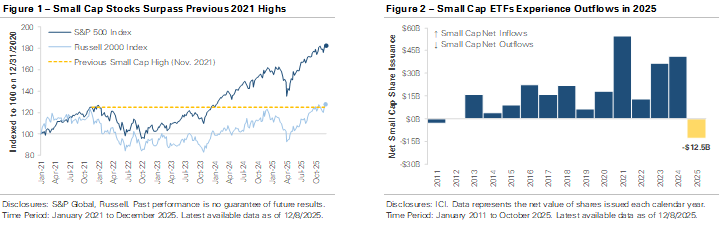

Large-cap stocks have dominated performance thanks to strong earnings, resilient economic growth, and ongoing enthusiasm for AI-driven innovation. But one part of the market has taken longer to recover: small-cap stocks. While large caps marched higher, small caps spent nearly four years below their 2021 peak. That trend began to change in late 2025 as expectations for Federal Reserve rate cuts sparked a breakout in the Russell 2000.

Why Small Caps Are Rebounding

Small-cap companies are more sensitive to interest rate movements because they often rely more heavily on borrowing. Rising rates during the Fed’s 2022–2024 tightening cycle weighed on margins and slowed growth. As the rate environment shifted in 2025, small caps began to recover. They outperformed large caps in Q3 by the widest margin since 2021, and the momentum has continued into Q4.

Valuations and Investor Sentiment Tell a Story

Despite this recent improvement, small-cap stocks remain deeply discounted compared to large-cap stocks. Investor flows reflect this imbalance: small-cap ETFs saw roughly $12.5 billion in net outflows through October 2025, their first year of net outflows since 2011. The disconnect between fundamentals and sentiment may signal an opportunity for long-term investors willing to look beyond market favorites.

Has Your Portfolio Drifted?

A strong performance in large-cap stocks may have shifted your allocation away from its intended targets. Rebalancing isn’t about timing the market—it’s about maintaining discipline. With the S&P 500 increasingly concentrated in a handful of mega-cap names, adding small-cap exposure may help restore balance and diversification.

Small caps also offer a different economic profile: they are more domestically focused, span a broader range of industries, and are less dependent on the AI narrative. While they tend to be more volatile, the combination of lower valuations, improving fundamentals, and light investor positioning presents a compelling case for revisiting this segment in 2026.

As always, any allocation change should reflect your long-term goals, risk tolerance, and overall financial plan.

IMPORTANT DISCLOSURES

Clare Market Investments, LLC is a Registered Investment Advisor. This material is for informational purposes only. It is not intended as and should not be used to provide investment advice and is not an offer to sell a security or a recommendation to buy a security. The information is derived from sources believed to be reliable and accurate as of the date of this report, but Clare Market has not audited this information to validate accuracy. Further, information may be at a point in time and subject to change. This summary is based exclusively on an analysis of general market conditions and does not speak to the suitability of any specific proposed securities transaction or investment strategy. Judgments or recommendations found in this report may differ materially from what may be presented in a long-term investment plan and are subject to change at any time. This report’s authors will not advise you as to any changes in figures or views found in this report. Investors should consult with their investment advisor to determine the appropriate investment strategy and investment vehicle. Investment decisions should be made based on the investor’s specific financial needs and objectives, goals, time horizon, and risk tolerance. Except for the historical information contained in this report, certain matters are forward-looking statements or projections that are dependent upon risks and uncertainties, including but not limited to such factors and considerations such as general market volatility, global economic risk, geopolitical risk, currency risk and other country-specific factors, fiscal and monetary policy, the level of interest rates, security-specific risks, and historical market segment or sector performance relationships as they relate to the business and economic cycle. See claremarket.com for additional information and disclosures. © 2025 Clare Market Investments, LLC. All Rights Reserved.