"One of the important factors behind the fluctuations between bull and bear markets, between booms and crashes and bubbles, is that investor memory has to fail us - and fail universally - for the extremes to be reached." - Howard Marks

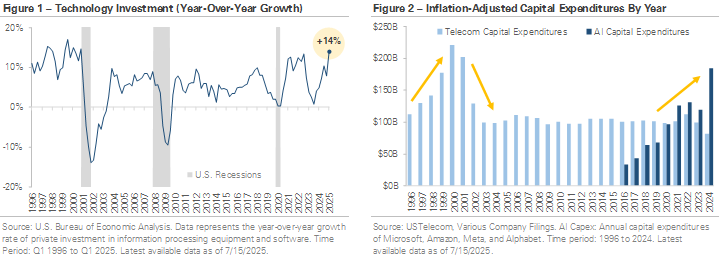

Technology spending is accelerating at the fastest pace in decades. Figure 1 shows that investment in information processing equipment and software grew by +14% year-over-year (YoY) in Q1 2025, the fastest pace since the late 1990s. During the dot-com era, investment in computers and software grew by over +15% YoY before collapsing in the early 2000s as the tech bubble burst. Tech investment rebounded in the mid-2000s but turned negative again in 2008 as economic growth slowed. Spending growth averaged a more modest +5.5% YoY in the 2010s, but it remained well below the highs of the late 90s. The COVID pandemic initially caused tech spending to stall, but it reaccelerated in recent years and is now growing at 1990s levels.

Figure 2 graphs annual capital expenditures by telecom and artificial intelligence (AI) companies, adjusted for inflation. The data reveals two distinct eras of rapid technology investment. At the turn of the century, the world was transitioning to a more digital society. In the late 1990s, telecom companies invested heavily to lay fiber, construct cell towers, and build the internet’s physical backbone. Telecom investment slowed in the early 2000s before stabilizing over the past two decades. Today, a new wave of tech investment is underway, driven by advancements in AI. Leading tech companies are investing billions in computer chips to train AI models, data centers to run the models, and new energy infrastructure to support it all. The chart shows AI capex could soon surpass the telecom peak from the late 1990s.

The latest tech spending boom has had a significant impact on the stock market. Over the past two years, the S&P 500 technology sector gained +66%, outpacing the S&P 500’s +42% return. The “Magnificent 7,” a group of mega-cap AI leaders that includes Nvidia, Microsoft, Amazon, and Meta, returned +89% over the same period, more than double the S&P 500’s price return. The group’s large index weight and its ability to convert the AI industry’s momentum into earnings growth have driven the stock market to a series of record highs.

This period is a historical moment, marked by billions being spent to develop a transformative technology. Two takeaways come to mind when reviewing the figures below. First, as the late 1990s telecom boom showed, today’s rapid growth will eventually return to a more normal level. The current growth rate is unlikely to continue indefinitely, and Figure 1 shows tech investment has historically been tied to overall economic growth. Second, today’s spending levels are a reminder that the U.S. economy has a strong track record of innovation and economic resilience. Investing in the stock market offers a way to participate in and benefit from those advancements.

IMPORTANT DISCLOSURES: Clare Market Investments, LLC is a Registered Investment Advisor. This material is for informational purposes only. It is not intended as and should not be used to provide investment advice, and is not an offer to sell a security or a recommendation to buy a security. The information is derived from sources believed to be reliable and accurate as of the date of this report, but Clare Market has not audited this information to validate accuracy. Further, information may be at a point in time and subject to change. This summary is based exclusively on an analysis of general market conditions and does not speak to the suitability of any specific proposed securities transaction or investment strategy. Judgements or recommendations found in this report may differ materially from what may be presented in a long-term investment plan and are subject to change at any time. This report’s authors will not advise you as to any changes in figures or views found in this report. Investors should consult with their investment advisor to determine the appropriate investment strategy and investment vehicle. Investment decisions should be made based on the investor’s specific financial needs and objectives, goals, time horizon, and risk tolerance. Except for the historical information contained in this report, certain matters are forward-looking statements or projections that are dependent upon risks and uncertainties, including but not limited to such factors and considerations such as general market volatility, global economic risk, geopolitical risk, currency risk and other country-specific factors, fiscal and monetary policy, the level of interest rates, security-specific risks, and historical market segment or sector performance relationships as they relate to the business and economic cycle. See claremarket.com for additional information and disclosures. © 2025 Clare Market Investments, LLC. All Rights Reserved.